Latest News

Katherine Kolnhofer will be speaking at this year’s NetDiligence on Top Data Breach Response Mistakes

Class Actions: COVID-19 in Long-Term Care Homes

Bell Temple LLP partners Lisa Hamilton and Andrew Lee, and associate, Tina Jian, successfully argued against certification on behalf of two independent homes involved in a class action lawsuit arising from the COVID-19 pandemic, after

Bell Temple LLP is pleased to announce that our partner Andrew Lee has been named one of Post City Magazines and Streets Of Toronto’s Best Lawyers of 2023!

The list features over 300 lawyers across multiple practice areas. Lawyers in the directory are nominated by their peers for this prestigious honor.

To read the listing in the November edition of Bayview Post

Our Associate, Damien Van Vroenhoven, will be presenting top 10 LAT decisions at the CDL Annual Accident Benefits Fall Classic on November 23, 2023.

Register here:

https://www.cdlawyers.org/events/calendar.html/event-default/index/id/294

Bell Temple Rocks the YWL Gala Social

Happy Friday! Bell Temple rocked it at the YWL Gala Social last night – a fantastic event which included a riveting and unforgettable conversation with the distinguished Lisa LaFlamme! Big thank you to

Each Year on September 30th, we observe the National Day for Truth and Reconciliation. In commemoration of this day, Bell Temple LLP has made a donation to the Indian Residential School Survivors Society.

Bell Temple LLP is proud to support Vancestock XII taking place on Friday, September 29 in the TD Music Hall at the Allied Music Centre!

Vancestock is an annual charity fundraiser supporting Trails Youth Initiative. Trails takes inner-city, at-risk youth at age 12 and provides a transformative experience. 90% of the youth complete the program at age 16

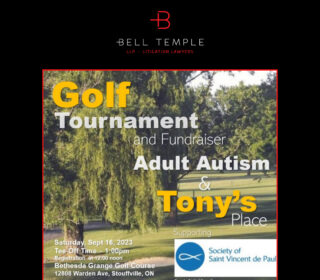

Bell Temple LLP is proud to support the 1st Annual Golf Tournament and Fundraiser for Adult Autism and Tony’s Place.

This event provides an opportunity to bring awareness to Adults with Autism and their families and to help support this special cause.

Bell Temple LLP is pleased to support the Young Women in Law 12th Annual Charity Gala which will take place on October 5, 2023, at the Toronto Board of Trade. We wish YWL much success with this year’s Gala and thank YWL for the work it does in our legal community.

Congratulations to our Partner Katherine E. Kolnhofer on being honoured as one of 2024 Best Lawyers (Insurance Law).

Court orders defendant substantial indemnity costs for beating offer.

CITATION:Grotz v. 1392275 Ontario Inc. o/a Hilton Garden Inn Toronto/Markham

2023 ONSC 4542

COURT FILE NO.: CV-14-120827

DATE: 20230808

SUPERIOR COURT OF JUSTICE – ONTARIO

RE: Brent Grotz, Plaintiff

AND:

1392275 Ontario Inc. o/a Hilton Garden Inn Toronto/Markham and Pileggi

Genevieve Durigon was Honoured to be Invited to LawPRO’s® 2nd Annual Women’s Networking Event

9th June 2023

Our associate Genevieve Durigon was honoured to be invited to attend LawPRO’s® 2023 Women’s Preferred Counsel Networking Event held at the Advocates’ Society on June 9, 2023. This annual event—the second of its

Congratulations to our Partners Hugh Brown, Lora Castellucci and Ryan Truax, on their respective trial wins.

Acknowledgement to our associate, Neema Nikzad, and student, Angus Chalmers, for their assistance on the trials.

Applications are open for the 2024 Articling Student Program!

Bell Temple LLP is a top insurance and commercial litigation boutique located in the heart of downtown Toronto. Having been established in 1945, we have grown to a dynamic team of 35 lawyers

Bell Temple LLP is a proud sponsor of NetDiligence® Cyber Risk Summit 2023 in Toronto

Bell Temple LLP is a proud sponsor of NetDiligence® Cyber Risk Summit 2023 in Toronto. Our very own Katherine Kolnhofer will be discussing Disclosure in Incident Response on March 28! We look forward to connecting

Bell Temple LLP is honoured to be recognized once again as one of the Top 10 Insurance Litigation Boutiques by Canadian Lawyer Magazine.

Our firm takes great pride in being acknowledged as a Top 10 Insurance Defense Boutique by Canadian Lawyer Magazine. We are thankful for the support of our colleagues, peers, and most importantly, our

Bell Temple LLP was honored to participate in the 2022 Blakes Law Firm Challenge to support the Daily Bread Food Bank.

Bell Temple LLP was honored to participate in the 2022 Blakes Law Firm Challenge to support the Daily Bread Food Bank. Thanks to everyone’s generosity, the Daily Bread Food Bank is able to

Joseph Baldanza, Lora Castellucci, Genevieve Durigon and Damien Van Vroenhoven were honoured to attend the LawPRO® Preferred Counsel Lunch

November 18, 2022

Our lawyers Joseph Baldanza, Lora Castellucci, Genevieve Durigon and Damien Van Vroenhoven were honoured to be invited to LawPRO’s Preferred Counsel Lunch held at the Omni King Edward Hotel on November 18, 2022.

Bell Temple LLP is pleased to announce that our partner Andrew Lee has been named one of Post City Magazines and Streets Of Toronto’s Best Lawyers of 2022!

November 17, 2022

The list features over 300 lawyers across multiple practice areas. Lawyers in the directory are nominated by their peers for this prestigious honor.

To read the listing in the November edition of Bayview Post –https://lnkd.in/gwaWNijJ

Congratulations to our Partner Steven Carlstrom in his recent success at the Superior Court of Ontario!

October 25, 2022

“Congratulations to our Partner Steven Carlstrom in his recent success at the Superior Court of Ontario!

The plaintiffs brought a motion pursuant to Rule 21 of the Rules of Civil Procedure to determine whether

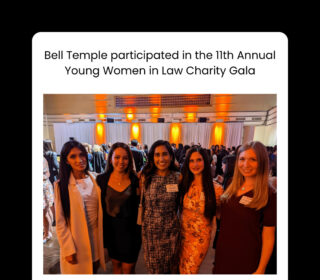

Bell Temple participated in the 11th Annual Young Women in Law Charity Gala

October 6, 2022

Bell Temple participated in the 11th Annual Young Women in Law Charity Gala to support the Pro Bono Inmate Appeal Program (PIAP), which provides free and high-quality legal assistance to unrepresented appellants with

Congratulations to our Partner Ryan Truax on his recent success in opposing the Plaintiff’s motion to amend her claim to transfer the action to Simplified Procedure and strike the Defendant’s Jury Notice.

June 2, 2022

The Plaintiff commenced an action on January 28, 2019 in the ordinary procedure alleging injuries sustained in a motor vehicle accident. The Defendant delivered a statement of defence and jury notice on April

Katherine E. Kolnhofer talks about Cyber - Maritime Industry

June 18, 2022

On June 18, our partner Katherine E. Kolnhofer had the opportunity to present at the Canadian Maritime Law Association.

Genevieve Durigon and Lora Castellucci were honoured to attend LawPRO® Women’s Networking Event

June 15, 2022

Our Genevieve Durigon and Lora Castellucci were honoured to attend the inaugural LawPRO® Women’s Networking Evening held at the Advocates’ Society on June 15, 2022. This event brought LawPRO® professionals together with counsel

Welcome & Congratulations to our Newest Associates!

Bell Temple LLP is pleased to announce that Andrew Garabedian, Marcus Rozsa and Neema Nikzad have joined the firm as Associates upon their recent call to the Bar.

Congratulations to our Andrew K. Lee on his recent success at the Supreme Court of Canada!

The plaintiff OZ Merchandising Inc. commenced an action seeking damages for negligence and intentional interference with its economic interests against the numerous defendants. The action proceeded to trial over a 9-week period against

Bell Temple is proud to support the Osgoode Women’s Network

Bell Temple was proud to support the 2022 “OWN Your Career” event presented by the Osgoode Women’s Network (“OWN”) on March 8, 2022—International Women’s Day. This event—attended by our associate, Genevieve Durigon—brought women-identifying

Congratulations to Lisa E. Hamilton and Genevieve Durigon on their recent success in challenging an appeal of a Master’s order that required the plaintiff to produce the family law lawyer’s litigation file

In the tort action of Veneris v. Parker et. al. (ONSC Court File No. CV-19-00614403-0000), the plaintiff claims in part that he suffered increased legal fees as a result of the alleged misconduct

Our Genevieve Durigon comments on changes to the Ontario Rules of Civil Procedure concerning pre-trials, evidence at trial and other matters

Reg 18/22—filed under the Courts of Justice Act on January 21, 2022—introduces various changes to the Ontario Rules of Civil Procedure with respect to pre-trials, evidence at trial and other matters.

Evidence at Trial

Now,

Congratulations to our partner Katherine Kolnhofer for her recent Osgoode Certification in Blockchain Law!

Congratulations to David Tompkins, Trevor Buckley and Mark Borgo for their recent success at the Supreme Court of Canada!

The Supreme Court of Canada (“SCC”) released its decision in the Trial Lawyers Association of British Columbia (“TLABC”) v. Royal & Sun Alliance Insurance Company of Canada (“RSA”), with our David Tompkins, Trevor

Bell Temple is proud to support the Black Law Students Association at Osgoode Hall

Several of our BT lawyers were honoured to attend the recent External Mentorship Launch initiative of the Black Law Students Association at Osgoode. The mentorship program will provide an opportunity for Black students

Congratulations to our partner Hugh Brown on his recent successful motion for summary judgment!

In an endorsement dated October 19, 2021 in the action of Shi v. Zhao et al (ONSC Court File No. CV-20-641798), Her Honour Justice P. Tamara Sugunasiri dismissed the plaintiff’s action on the

Bell Temple marks the first National Day for Truth and Reconciliation - today honours the lost children and Survivors of residential schools, their families and communities. We take time to commemorate this tragic and painful history and ongoing impacts of residential schools #WeWearOrange

Congratulations to our partner Andrew Lee on his recent success in the Ontario Court of Appeal!

In its recently released decision of OZ Merchandising Inc. v. Canadian Professional Soccer League Inc., 2021 ONCA 520 the Court of Appeal dismissed the plaintiff’s appeal of the decision of the Trial Judge following a

Managing Mental Health in Trying Times - Bell Temple welcomes speaker Marla Warner

Bell Temple was pleased to have Marla Warner join us for a Zoom webinar on June 28, 2021 where she focused on managing mental health in the context of the pandemic.

Marla is a

Congratulations to our 2020 / 2021 articling students - Anja Perc, Maryam Younes and Brett Webster, on their call to the Bar. Anja, Maryam and Brett will be returning as associates and we look forward to having them back!

Bell Temple welcomes new associates Jillian Beaulieu, Dylan Bal and Taras Kuper!

Katherine Kolnhofer will be moderating at NetDiligence on April 26, 2021 11:45 am - Cyber Claims and Losses Trends and Updates

Bell Temple honoured to again be named as a Top Ten Insurance Litigation Boutique by Canadian Lawyer Magazine

We are proud to once again be named a Top 10 Insurance Defence Boutique by Canadian Lawyer Magazine. Thank you to our colleagues and peers, and most of all our clients. We are proud

*Update - Amendments to the Occupiers' Liability Act came into effect January 29, 2021

Our associate Genevieve Durigon with comment:

A bill to amend the Occupiers’ Liability Act to add a requirement of written notice for claims arising from injuries caused by snow and ice was given assent.

2021 Firm Update - we are pleased to announce that Brenda Lockwood and Adrian Serpa have joined the partnership. Also, Lora Castellucci has been appointed as our new managing partner. We thank Andrew Lee for his years of service in that role and congratulations to Brenda, Adrian and Lora!

Our partner Lora Castellucci will be presenting on the Top 10 Accident Benefit cases of 2020 at the upcoming Accident Benefits Fall Classic on December 3, 2020

Date: December 3, 2020 Length: Half Day 9 am – 12:00 pm EST

Where: Live Online

Cost: CDL Members $226.00 Non-Members $310.75

Claims Managers and Adjusters Special Rate: $163.85

Contact [email protected] to register

Accreditation: Approx 3 hours CPD (to

Steven Carlstrom will be presenting to the Property and Casualty Underwriting Club this coming Thursday, October 29, 2020 (see link below)

https://www.canadianunderwriter.ca/events/riding-the-waves-of-covid-19-insurance-coverages/

Belated congratulations to Danielle Tavernese, Norman Yallen and Sean Frankland on their hireback to the firm at the conclusion of their articles!

Katherine Kolnhofer will be speaking on Cyber Risk Management from a legal and operational perspective at the Big Data & AI virtual conference on September 29 at 4 pm - register to join!

Bell Temple welcomes new associates Jaspal Sangha and Raymond Ashurov!

Bell Temple welcomes our 2020 / 2021 articling students Anja Perc, Maryam Younes and Brett Webster!

Katherine Kolnhofer speaking on Operational and Cyber Risk Management and the Impact of COVID 19

On August 26, 2020 at 9:30 a.m. EST Katherine will be participating in a webcast discussion titled “Operational and Cyber Risk Management | Transportation Sector – Impact of COVID -19.”

The transportation sector has

The Ongoing Impact of COVID on Litigation - Practical Advice on How to Navigate a Global Pandemic

The last few months have been unprecedented for all persons in Canada. Governments and businesses have been forced to alter, adapt, and in many cases, cease operations in order to respond to the

* Bell Temple Updated COVID-19 Response *

As most are aware, the Province has now declared a state of emergency and has ordered the closure of non-essential services. Lawyers are exempt as an essential service. At Bell Temple, we are fortunate

Congrats to Ryan Truax on his recent decision pertaining to partial summary judgment #litigators

Medeiros v. Petopia Ltd. et al 2020 ONSC 1562 is one of the few cases that addresses partial summary judgment in the context of when some, but not all, defendants are released from

* Bell Temple's COVID-19 Response *

Our firm measures in regards to COVID-19

To our valued clients and colleagues,

As you all know, the spread of the novel Coronavirus which causes COVID-19 has been categorized as a pandemic by the World

Bell Temple (once again) named one of Canada's Top 10 Insurance Boutiques

We are pleased to announce that the firm has again been named by Canadian Lawyer magazine as a Top 10 Insurance Defence Litigation Boutique for 2020 – 2021. As always, the rankings were

Join our Katherine Kolnhofer to get an update on Breach Reporting, Investigation and Enforcement Activity on February 21 @NetDiligence Cyber Risk Summit!

Our partner Katherine Kolnhofer presented on Cyber Crime and best practice in dealing with this ever-changing threat at the recent #OIAA conference in Toronto

We are pleased to announce that Trevor Buckley has been made Partner at the firm, effective January 1, 2020

Katherine Kolnhofer will be presenting on Cyber Crime at the OIAA Conference on January 22, 2020

Kendall Cumming becomes an Equity Partner, effective 2020

January 1, 2020

Bell Temple LLP attends IBAO Convention

October 24, 2019

Kendall, Ryan and Steve would like to thank our friends at the Insurance Brokers Association of Ontario for having us at their hospitality night at the Sheraton Hotel in Toronto, on October 24, 2019. We had

Congrats to Derek Abreu and Mark Borgo for their victory at the Court of Appeal, in a case involving an insurer taking an off-coverage position due to a policy violation.

October 7, 2019

Bradfield v. Royal & SunAlliance Ins. Co., 2019 ONCA 800

Congrats to Derek Abreu and Trevor Buckley for their victory at the Court of Appeal, upholding the dismissal of a plaintiff's action.

September 5, 2019

In Erland v. R.W. Tomlinson Ltd. et al., the plaintiff claim’s for injunctive relief and damages for the flooding of his land was initially dismissed for delay at a status hearing by Justice

Congrats to Andrew Lee for a shut out verdict, after a 9-week commercial litigation trial in Ottawa.

August 27, 2019

OZ Merchandising v. Canadian Soccer Association – Reasons for Judgment – Released August 27 2019

Bell Temple welcomes 4 articling students for 2019-2020

August 6, 2019

Bell Temple LLP is pleased to welcome to the firm the following articling students for 2019-2020: Sean Frankland, Danielle Tavernese, Adin Wagner and Norman Yallen.

Congrats to David Tompkins and Trevor Buckley for their victory at the Court of Appeal, resulting in the dismissal of a plaintiff's actions.

August 3, 2019

In Marvelous Mario’s Inc. v. St. Paul Fire and Marine Insurance Co., 2019 ONCA 635, the plaintiffs commenced two separate actions to claim for insurance proceeds under a commercial general liability policy in

Congratulations to Tina Jian-Ahmadi on her Call to the Bar, and on being Hired Back.

June 26, 2019

Congratulations to Tina Jian-Ahmadi on her Call to the Bar at the Law Society of Ontario, on June 26, 2019. Tina started at Bell Temple LLP as an articling student in July 2018,

Congrats to Derek Abreu for a shut out jury verdict in an Occupiers Liability case. #belltemple #litigators

June 21, 2019

Bell Temple attends Bay of Quinte Mutual Ins. Charity Golf Tournament.

June 19, 2019

Bell Temple LLP wants to thank its friends at Bay of Quinte Mutual Insurance for a great day at its Annual Charity Golf Tournament, recently held at Timber Ridge Golf Course, in Brighton,

Bell Temple sponsors the WICC Gala 2019.

May 8, 2019

Bell Temple LLP is proud to have joined the fight against cancer by being a sponsor and supporter of the WICC Gala 2019. A wonderful evening of entertainment and camaraderie with other industry

Anna Iourina joins Bell Temple as a new Associate.

April 22, 2019

Bell Temple LLP is pleased to welcome Anna Iourina (2016 call) as a new Associate at the firm. Anna brings a wealth of experience in working on complex files, and will be a

Ryan Coughlin representing Radiohead at Coroner's Inquest interviewed by Global News

April 10, 2019

link to interview

Katherine Kolnhofer panelist at NetDiligence Cyber Risk Summit #cybersecurity #netdiligence

April 3, 2019

Katherine Kolnhofer panelist at NetDiligence Cyber Risk Summit

https://netdiligence.com/conferences/cyber-risk-summit-toronto-2019

Cam Godden retires from Bell Temple LLP.

March 25, 2019

Cam Godden retired from Bell Temple in March 2019, after having been the face of the firm for over 45 years. He started at Bell Temple as an articling student, and went on

James Hirsh and Victoria Locs join Bell Temple LLP as new Associates.

March 11, 2019

Bell Temple LLP is pleased to welcome James Hirsh (2015 call) and Victoria Locs (2017 call) as new Associates at the firm. They will be valuable additions to our expanding team of lawyers,

Bell Temple Named One of Canada’s Top 10 Insurance Defence Boutiques!

January 1, 2019

Bell Temple LLP is pleased to announce that the firm has been named by Canadian Lawyer magazine as a Top 10 Insurance Defence litigation boutique for 2019-2020. The magazine’s rankings were obtained through

Ryan Truax is made a Partner at the firm.

January 1, 2019

Congratulations to Ryan Truax, who was made a Partner at Bell Temple LLP effective January 2019. Since starting his career at Bell Temple as an articling student, Ryan has proven to be a

Katherine E. Kolnhofer talks Cyber at Toronto Police Headquarters

November 15, 2018

On November 15, Katherine presented on BREACH READINESS & REPORTING IN CANADA @ the InfoSecTo Executive Seminar Series at Toronto Police Headquarters. #education #cyber #protection #litigation #regulations #techlaw

Congratulations to Sean Frankland, Danielle Tavernese and Adin Wagner on being hired as articling students for 2019-2020!

August 20, 2018